chances of retroactive capital gains tax

Reduced the maximum capital gains rate from 28 percent to 20 percent. Signed 5 August 1997.

Taxes Archives Page 2 Of 3 Cd Wealth Management

Capital Gains Tax.

. Biden plans to increase this. Oct26 -- Adam Sender founder of Sender Company Partners SCP discusses how he is positioning ahead of the 2020 presidential election. Effective for taxable years ending after 6 May 1997 ie for.

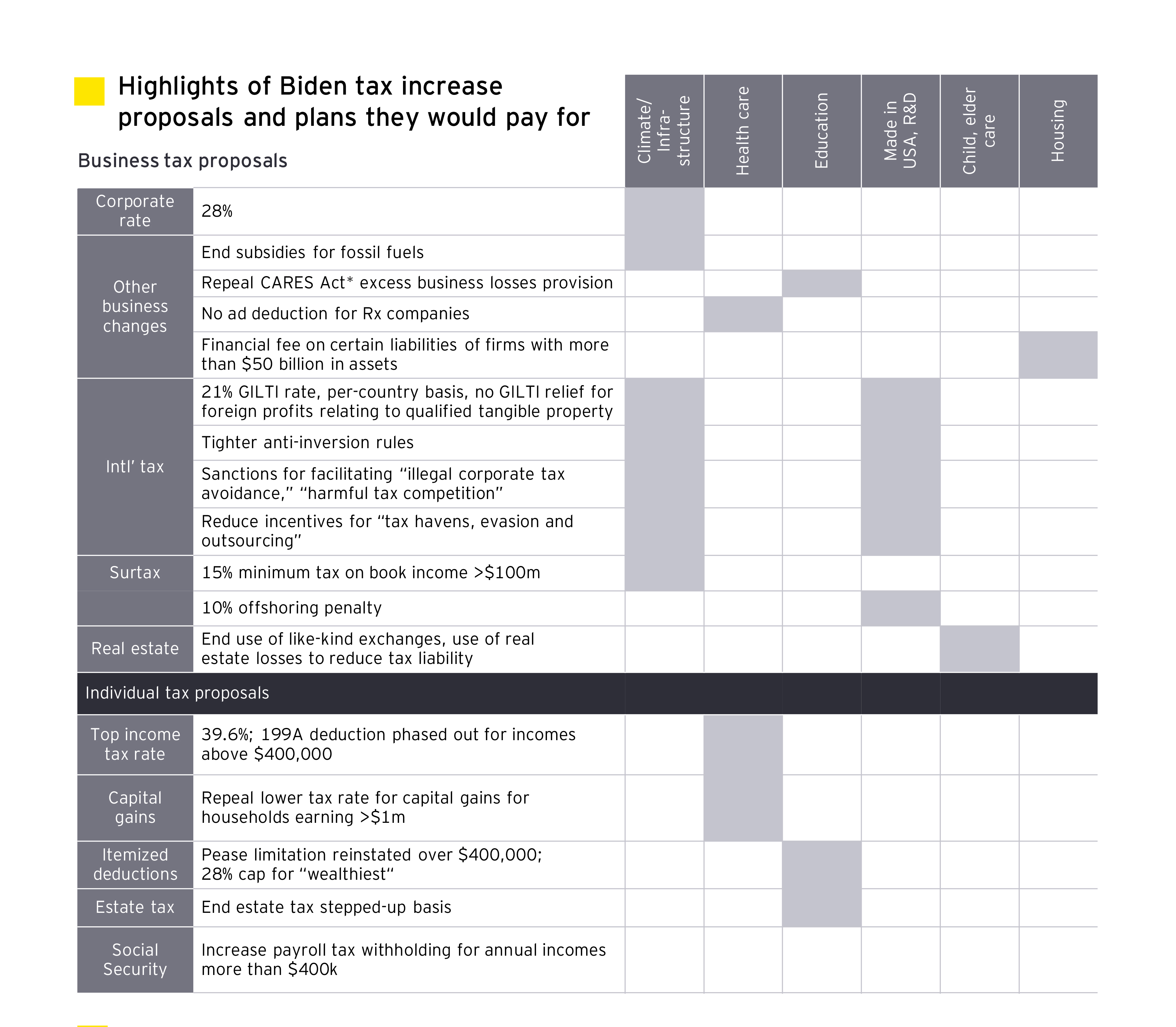

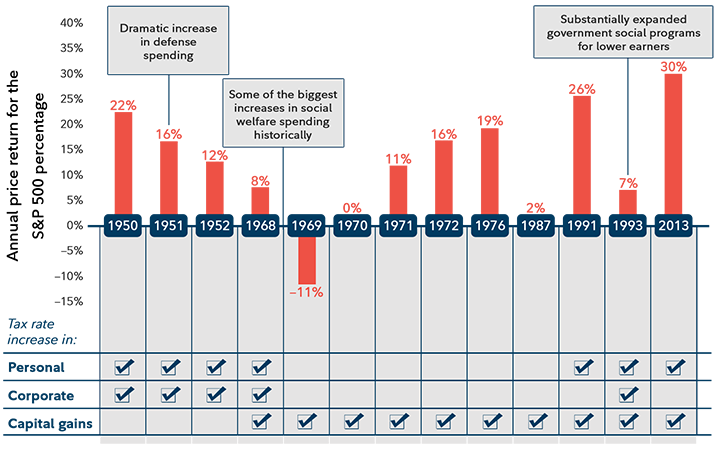

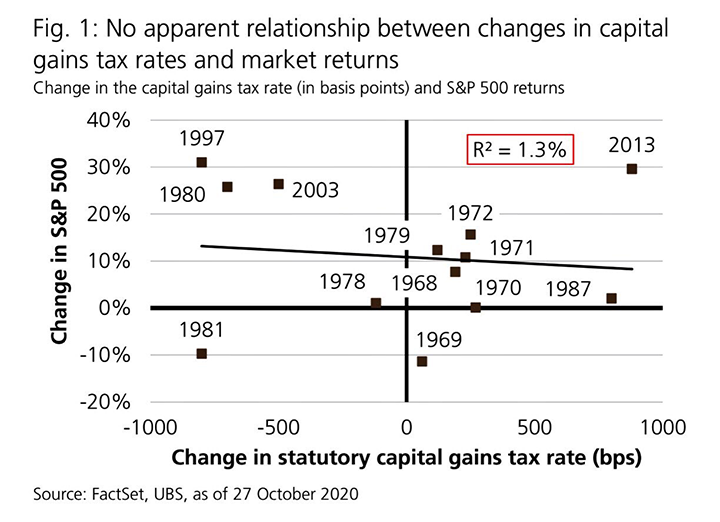

Schlosstein Sees Low Probability for Retroactive. Whether or not the capital gains tax increase is retroactive the effects on investing and tax planning could be dramatic. Bidens pre-election proposal advocated almost doubling the top tax rate on capital gains from the current 20 or 238 including the Medicare surtax to a rate equal to that for.

If the effective date is retroactive to April 2021 it will be too late for investors to sell to avoid the tax increase. Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the. 7 rows Introduced 24 June 1997.

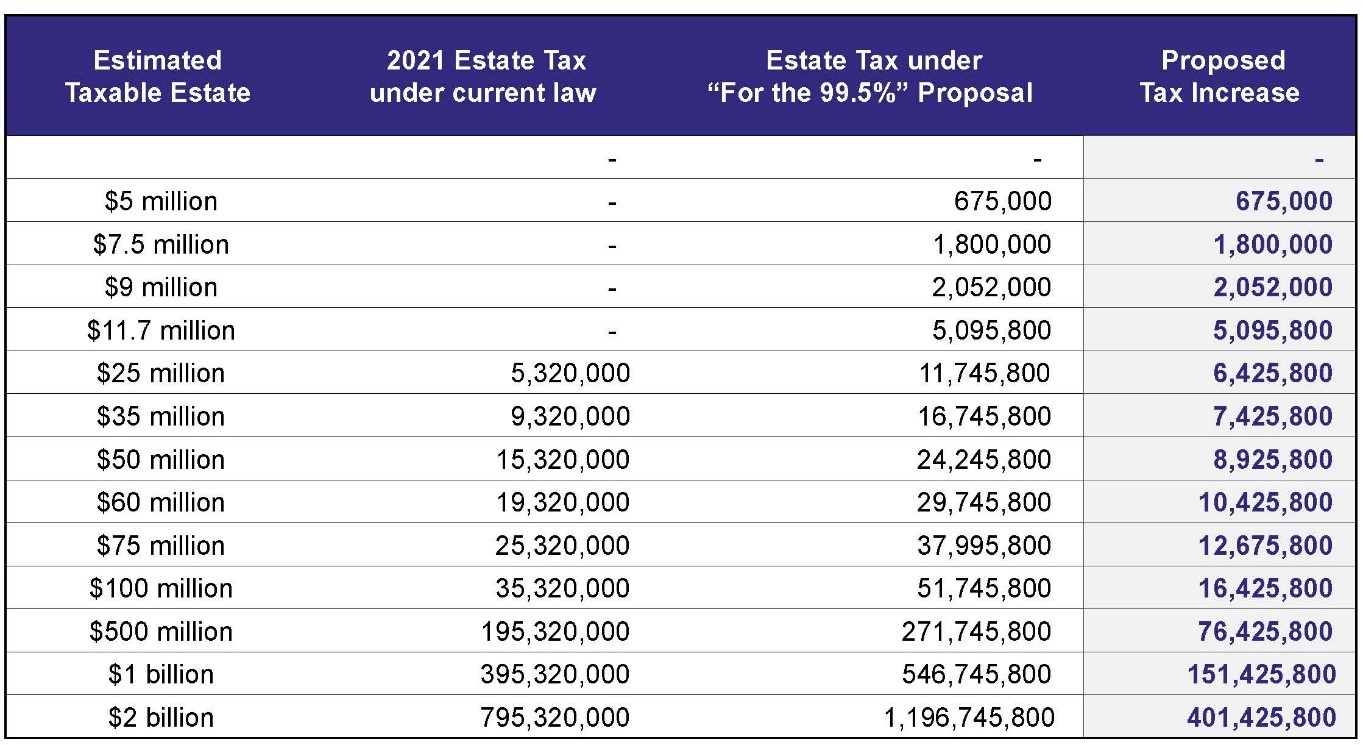

The clients capital gains would be taxed at their ordinary income marginal tax rate which is 37 for 2021 but would rise to 396 in 2022 under the Biden budget plus the 38. Otherswhich will likely not be. A Retroactive Capital Gains Tax Increase.

Perhaps the most newsworthy item in the Treasury Department Greenbook was the Biden Administrations proposal to increase taxes on capital gains on a retroactive basis. A capital gains tax is a type of tax levied on capital gains. Currently the top capital gain tax rate is 238 percent for gains realized on assets held longer than a year.

The plan to make its tax increases retroactive makes no sense if the objective is as the Biden administration claims to raise revenue rather than to punish the successful. He speaks on Bl. Donors will be able to give gifts without realization if the estate provisions take effect after 20 See more.

Top earners may pay up to. 2 Proposed Biden Retroactive. Apr 23 2021 305 AM.

Capital gains tax is likely to rise to near 28 rather than 396. So Ralph what about this retroactive capital gains idea that got a lot of pushback from the bank CEOs in Washington. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates.

What If Bidens Capital Gains Tax Is Retroactive. My guess is that since the Democratic majority is so thin there is little chance any tax increase will be made retroactive to January 1 2021. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396.

Perhaps had Congress looked to enact such changes earlier in 2021 the chance to make the capital gains tax changes retroactive to perhaps the start of the year would have. An analysis by Joe Bishop-Henchman of the National Taxpayers Union Foundations. 1 day ago Jun 21 2021 For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates.

The proposed tax increase on capital gains may be applied to taxpayers with annualized realized gains over 1 million with those high net families paying a higher tax rate. Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

The New Tax Proposal Is Prepared For Moass Retroactive Capital Gains R Superstonk

Biden S Ex Post Facto Capital Gains Tax Increase Wsj

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Taxes Archives Page 2 Of 3 Cd Wealth Management

Advisers Blast Biden S Retroactive Capital Gains Proposal

75 Of Stock Owners Won T Pay Biden S Proposed Capital Gains Tax Hike

Wall Street Panicking That Biden S Tax Hikes Will Be Retroactive

Who S Afraid Of Higher Capital Gains Tax Not Stocks At Least For Now Barron S

Yellen Argues Capital Gains Increase From April 2021 Not Retroactive Bloomberg

How Will A Capital Gains Tax Hike Affect Red Hot Ria M A Market Investmentnews

How To Prepare For A Retroactive Capital Gains Tax Hike Thinkadvisor

Planning Now For The Estate Tax Overhaul Sax Wealth Advisors Llc

What Are Capital Gains Taxes And How Could They Be Reformed

Preparing For Tax Hikes Plan But Dont Panic Bny Mellon Wealth Management

In Case Of Capital Gains Tax Hike Don T Panic Thinkadvisor

Schlosstein Sees Low Probability For Retroactive Capital Gains Tax